Decentralized Finance (DeFi) is a loosely defined concept that describes an ecosystem within the blockchain industry, offering traditional financial services and products in a decentralized manner.

The core idea behind decentralized finance is to provide both the banked and unbanked populations with the opportunity to participate in a transparent, public, and permissionless financial network that requires no intermediaries. DeFi can be defined by its three fundamental principles.

In centralized finance, governments control the flow of money and banks have control over our funds. Banks, as central authorities, can do anything with your money, essentially leaving you without control over your assets, and without the ability to argue against their actions. On the other hand, decentralized finance is powered by code running on the decentralized infrastructure of the Ethereum blockchain. By deploying immutable smart contracts on Ethereum, DeFi developers can launch financial protocols and platforms that run exactly as programmed and are available to anyone with an internet connection.

Comparison Between Traditional Finance and Decentralized Finance

As discussed, operations of DeFi are not managed by institutions and employees. Instead, they are managed by algorithms written in code, or via smart contracts. Once a smart contract is deployed to the blockchain, DeFi apps run without any human intervention. This contrasts with traditional finance, where intermediaries such as banks manage financial operations.

One of the key features of DeFi that clearly distinguishes it from traditional banking applications is its transparency. The code that manages DeFi applications provides open visibility, making it possible for anyone to conduct an audit. This promotes trust with users as everyone has the opportunity to understand the contract’s functionality. In stark contrast, traditional finance operates through intermediaries, which means there is less control over assets and potential security breaches may occur.

In terms of geographical reach, traditional financial systems are often restricted to their localities — a specific geographical location. This means you can only open a bank account in countries where the bank operates. DeFi services and networks, however, operate universally.

Finally, anyone can create and use decentralized finance applications. Unlike today’s finance industry, there are no accounts or gatekeepers. Users interact directly with smart contracts from DeFi crypto wallets.

DeFi and the Real World

The rising adoption of DeFi platforms has the potential to transform the lives of the unbanked worldwide. In this section, we will discuss a few key applications of DeFi in real-world contexts.

Reducing Costs: Foreign workers, who send billions across borders to their families, are often subject to exorbitant fees. Luckily, the emerging trends in decentralized finance services have the potential to reduce these costs by more than 50%. This not only boosts the productivity of these workers but also contributes to economic growth.

Borrowing and Lending: Loans represent another complex area where focusing on the advantages of DeFi can be transformative. Currently, it’s nearly impossible for the unbanked to borrow money due to a lack of credit score or a poor history with a banking institution. DeFi platforms connect borrowers directly with lenders, thereby eliminating the traditional credit check process.

Supply Chain Management: As previously noted, DeFi represents a shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. This revolutionary movement has begun to intersect with the supply chain management industry, creating new possibilities for streamlining inefficiencies and fostering trust less collaboration and decentralized financing.

A practical example of this is the collaboration between Maersk and IBM to develop TradeLens. This platform facilitates the instant sending and retrieval of various documents, thereby speeding up supply chain processes.

These examples merely scratch the surface of how blockchain is shaping the fintech domain. By eliminating inaccuracies and fostering transparency, blockchain is gearing up to devise new use cases for DeFi platforms.

How Does DeFi Work?

From a technical perspective, DeFi refers to a collection of decentralized applications (dApps) primarily built on the Ethereum smart contract ecosystem. These apps provide blockchain-based financial services, dispelling the need for intermediaries. Understanding how DeFi works hinges on peripheral knowledge of three critical factors: blockchain technology, Ethereum, and smart contracts. These topics have been briefly introduced below:

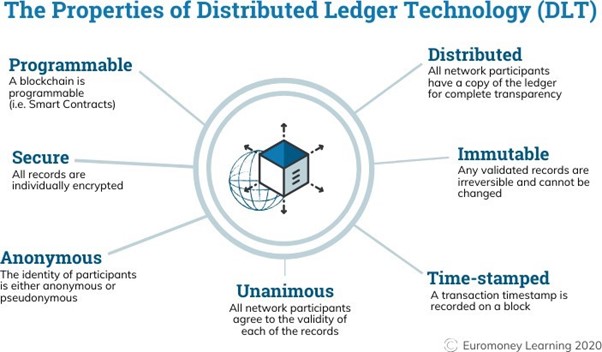

A. Blockchain

Blockchain technology forms the foundation not only for DeFi, but also for all facets related to cryptocurrencies. Essentially, blockchains are digital ledgers that permanently record immutable data. The data, segmented into blocks, is publicly accessible, providing a level of transparency that is central to these technologies.

B. Ethereum & Smart Contracts

Ethereum, another cryptocurrency, extends the utility of blockchain technology with the introduction of smart contracts. These contracts are coded in the Solidity programming language, creating a rich dApp environment that introduces on-chain features going beyond mere payments.

Smart contracts are self-executing pieces of computer code written in the Solidity language. Any individual can read and assess a smart contract’s code to determine its integrity – whether it might be malicious, for example. Furthermore, smart contracts operate strictly according to their programming, ensuring that Ethereum transactions always proceed as expected.

Essentially, smart contracts function as neutral third-party intermediaries that process agreements made between two or more entities. They eradicate the need for trust in an otherwise trust less system, as users can rely on these smart contracts instead of depending on the goodwill of others. This not only simplifies transactions but also facilitates them, removing traditional centralized intermediaries like banks and exchanges from the process.

To simplify, Ethereum can be viewed as a variation of Bitcoin with the added functionality of smart contracts. This allows Ethereum to execute computational logic and incorporate features that are uncommon in first-generation blockchains.

The DeFi Ecosystem: Use Cases

For those who find DeFi an abstract concept, the best way to understand decentralized finance is by exploring its ecosystem and use cases.

DeFi represents a dynamic segment of the blockchain industry, catering to the diverse needs and demands of various users. If a financial product or service exists in the traditional financial world, there’s likely a blockchain-powered, Ethereum-based version.

The DeFi ecosystem is continually expanding, with several projects emerging each month that strive to establish their dominance in the market. Data from DeFi Pulse indicates that the entire DeFi sector holds $55 billion worth of crypto assets, and the top 10 projects each host at least a billion dollars in collateralized value.

Although most of the largest projects are decentralized exchanges and lending protocols, there are other noteworthy use cases worth exploring, as discussed in the sections below.

A. Decentralized Exchanges

Decentralized exchanges (DEXs) form the backbone of DeFi. They gained popularity among crypto investors as one of the first widely adopted DeFi services, primarily due to offering non-custodial, decentralized trading.

Centralized exchanges (CEXs) are operated by financial services companies, featuring order books maintained by market makers (MMs).

Centralization poses challenges in terms of security, trust, and privacy. Such exchanges are vulnerable to hacks, government bans, data misuse, identity leaks, and various other issues.

Conversely, DEXs are managed by developers and rely on smart contracts. These contracts execute trades, hold liquidity, process withdrawals and deposits, and cover other essential functions in trading. As a result, there is virtually no intermediary dealing with user funds or exerting control over them.

Popular DEXs include Uniswap, Bancor, dYdX, PancakeSwap, and SushiSwap. While most operate using Automated Market Makers (AMMs), some DEXs offer a CEX-like experience via order books.

Custodianship represents the primary difference between these two methods. In the former case, investors execute trades directly from their wallets, whereas in the latter case, users must deposit funds onto the DEX before trading.

As the mechanism of order books is widely understood, we will concentrate on the innovative concept of AMMs.

B. Automated Market Makers

An Automated Market Maker (AMM) is a type of smart contract that stores on-chain liquidity reserves, serving as a replacement for traditional order books. An AMM draws in liquidity from so-called liquidity providers — individuals who are financially incentivized to temporarily lend their cryptocurrency in exchange for fee-based rewards.

Instead of trading via an exchange’s order book, users conduct transactions with other users through interaction with a smart contract. This system comes with its own set of advantages and disadvantages.

Advantages

- Decentralization: Smart contracts are predefined agreements that execute commands autonomously. When combined with governance models, Decentralized Exchanges (DEXs) effectively transition both platform and asset ownership to its users, thereby eliminating any centralized entity.

- Non-Custodial: Traders and liquidity providers interact with DEXs directly from their crypto wallets, maintaining full custodianship of their assets. All transactions are defined and processed through smart contracts.

- No Manipulation: Centralized Exchanges (CEXs) are notorious for market manipulation and insider trading. As there is no centralized entity that could potentially benefit from such practices, DEXs are unable to manipulate prices in their favour.

- Security: DEXs are typically hosted in a distributed manner to safeguard against attacks. Furthermore, hackers can only engage with the liquidity pools on a trading platform, not with the individual users interacting with the exchange.

- Token Accessibility: Owing to their decentralized nature, any entity can list an asset on DEXs without the need for an owner-operated vouching or verification system.

Disadvantages

- Liquidity Limitations: While centralized exchanges also rely on user-provided liquidity, the level of dependency is not nearly as high as with decentralized exchanges. DEXs traditionally do not have their own liquidity pools and thus must be supplied by yield farmers who contribute their assets for other traders to utilize. Without these contributions, the exchange cannot provide trading services.

- Speed: Order execution is less efficient on DEXs in comparison to their counterparts, primarily due to the traditional lack of advanced trading tools.

- Volume and Slippage: DEXs have gained traction in terms of volume, yet the absence of an order book and a market maker means users encounter high slippage rates, especially with larger orders.

- Fees: The lack of an order book also implies no low fees. All users are subject to a fixed trading fee, along with gas fees imposed by the Ethereum network. In situations of network congestion, the fees for a single transaction can amount to hundreds of dollars.

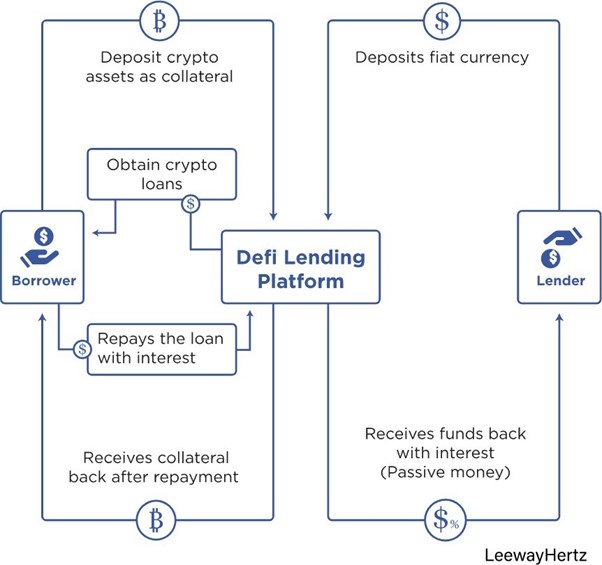

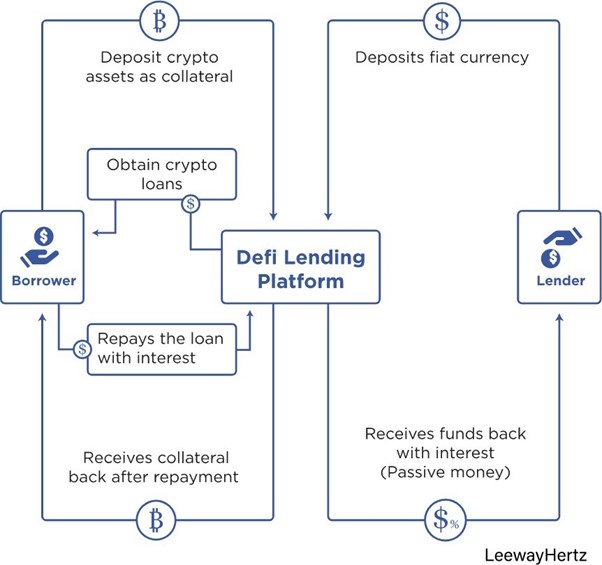

C. Lending

Lending and borrowing is the second-largest use case in decentralized finance (De-Fi).

In a centralized system, the only way to borrow funds is by requesting a loan from an intermediary, typically a bank. These intermediaries aim to protect their interests by lending funds only to individuals who meet certain criteria such as a good credit score, stable employment, a minimum amount of collateral, among others. Individuals without an account cannot request a loan in this system.

Decentralized finance (De-Fi) lending protocols eliminate all these barriers. This is particularly beneficial for those without a bank account. Being decentralized and universally accessible, these protocols are available to people of diverse backgrounds, races, and locations. As long as the necessary collateral can be provided, it is possible to take out a loan and utilize the newly acquired funds.

Aside from collateral, there are no additional requirements. Remarkably, lending protocols do not employ extensive identity checks like Know-Your-Customer (KYC) policies.

Famous lending protocols such as Compound, Aave, Maker, and bZx are dominating this space. Together, they host $26 billion worth of collateralized assets, accounting for nearly 50% of the entire De-Fi market.

D. Flash Loans

Traditionally, centralized banks give loans on the basis of collateral such as property papers.

Lending protocols, on the other hand, offer a unique type of loan called a flash loan. Unlike traditional loans, a flash loan requires no collateral, and users can request sums up to millions of dollars. However, the catch here is the repayment timeline. Flash loans need to be repaid almost instantly.

In fact, the lifecycle of a flash loan lasts only a single transaction block. Before the next block arrives, the borrower must repay the loan. A failure to do so necessitates the reversion of the original transaction and consequently, the loss of the borrowed funds. Flash loans are primarily used for swift operations such as arbitrage trading and debt refinancing. However, their complexity makes flash loans vulnerable to security exploits.

In summary, lending protocols serve as intermediaries between lenders and borrowers who interact by taking or providing crypto funds. Lenders enjoy the advantage of receiving higher than average interest, while borrowers gain the ability to instantly take out loans without dealing with extensive paperwork, in a wholly anonymous and safe manner.

E. Derivatives

Beyond simple token swapping, De-Fi also caters to complex trading products. More sophisticated decentralized exchanges offer decentralized derivatives. Their value is derived from an underlying asset such as currency, stock, index or commodity.

F. Yield Farming

Tightly linked to the workings of decentralized exchanges, yield farming stands as the premier use case in De-Fi.

Yield farming can be defined as a passive income strategy allowing investors to earn additional crypto by leveraging existing crypto assets. Essentially, yield farmers lend their cryptocurrency to a decentralized exchange in the form of liquidity and earn rewards in return.

Put simply, yield farming involves borrowing or taking tokens to a swap app, swapping those tokens, repeating this string of actions, and initiating the cycle anew.

Decentralized exchanges incentivize yield farmers by rewarding them with trading fees derived from users who execute trades using the yield farmer’s liquidity. This establishes a synergistic relationship among the DEX, traders, and liquidity providers, where each party benefits.

Every farmer earns fees proportional to their contribution to a liquidity pool. The yield farming process can last indefinitely. However, users are prompted to switch between pools to chase highly competitive yield rates. In yield farming, yield rates are considerably higher compared to similar activities.

G. Insurance

While smart contracts are decentralized and transparent, they are susceptible to security exploits that can lead to millions of dollars in losses. Even audited De-Fi projects can harbour vulnerabilities. In such cases, a hacker could potentially drain its entire liquidity pools.

Unlike centralized exchanges, decentralized exchanges (DEXs) bear no obligation to protect or compensate their clients in an incident of security breach. There are no insurance funds, a feature common to crypto exchanges like Binance, Gemini, and Coinbase.

For this reason, De-Fi investors are encouraged to utilize insurance protocols to safeguard their funds. These protocols provide protection not only from technical risks, such as exploits, but also from liquidity risks and administrative risks.

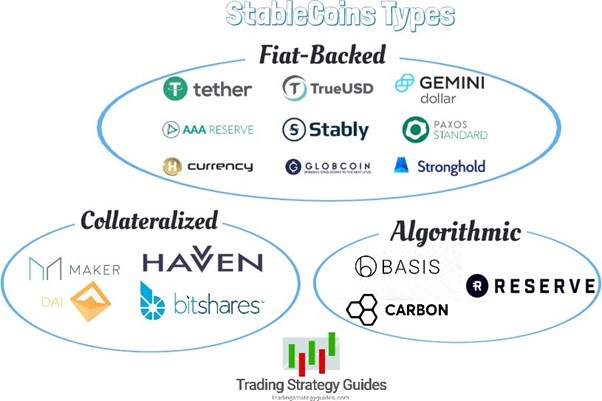

H. Stablecoins

One of the primary goals of De-Fi is to mitigate the uncertainty of token prices. This led to the development of stablecoins.

Stablecoins are cryptocurrencies whose value is pegged to fiat currencies. Given the volatile nature of cryptocurrencies, stablecoins are used as a hedge to shield against extreme market conditions. Additionally, they serve as a quick means to secure profits by converting cryptocurrencies into what is essentially a tokenized form of fiat.

The U.S. Dollar reigns supreme as the dominant stablecoin in the crypto market. The method of pegging a token’s value to the dollar varies from one stablecoin to another, with each project employing its own system to ensure zero volatility.

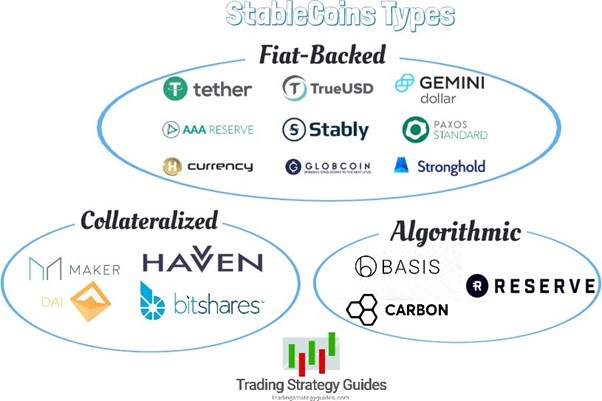

Types of Stablecoins

Stablecoins can be classified into two categories: fiat-collateralized and crypto-collateralized.

- Fiat-collateralized stablecoins are backed by actual fiat held within a project’s reserves. Tether (USDT), pegged to $1 and supported by reserves of $1 for every minted USDT token, is a prominent example of a fiat-collateralized stablecoin. Investors must trust Tether to maintain sufficient fiat reserves to back their crypto supplies. These reserves are held in financial institutions and banks. Considering all these, it’s clear that fiat-backed stablecoins are centralized.

- Crypto-collateralized stablecoins, on the other hand, are backed by cryptocurrencies instead of fiat. Take DAI for instance. DAI is built on the Ethereum network and utilizes smart contracts to maintain a $1 peg.

Since smart contracts are public, users can verify whether there’s enough collateral to back DAI’s token supply. Consequently, DAI is recognized as a decentralized stablecoin.

Decentralization is fundamental to the operation of the DeFi market, and stablecoins like DAI are vital for DeFi to remain 100% decentralized.

I. Governance

In the blockchain industry, governance models create a system where investors can directly impact the design and direction of a project. Similar to a company’s shareholders, the community members can express their opinions and actively participate in the decision-making process.

Governance promotes absolute decentralization and assigns all planning to the project’s investors, moving away from a developer-centric approach.

According to Ethereum co-founder Vitalik Buterin’s paper on Decentralized Autonomous Organizations (DAO), governance models function like companies operating without managers. Instead of depending on a small group of executives, the entire system employs smart contracts that process, execute, and accept various tasks and decisions.

Governance has crucial importance in De-Fi as it transfers the ownership of a protocol to its community. Most projects have a specific governance token that provides users with voting rights and the ability to create governance proposals.

Ideally, governance tokens are distributed fairly. One way to achieve this is by airdropping a portion of the cryptocurrency’s supply to active users, as Uniswap did with the launch of UNI in September 2020. During the launch, Uniswap allocated 60% of UNI’s genesis to the community via a 400 UNI airdrop.

Alternatively, decentralized protocols can introduce a governance token by merely listing it on an exchange without any fair distribution. Investors who have a positive outlook on the project’s future can invest in the token and gain voting rights as a result. As token holders also become voters, they are incentivized to make the best possible decisions.

How Governance Works in Practice

The act of voting and participating in governance revolves around the use of governance tokens. Once distributed, holders can propose changes and vote on existing proposals. Furthermore, community members can freely discuss governance issues and upcoming features on online forums hosted by the project.

All acts of governance necessitate the initiator to lock governance tokens into smart contracts for the duration of the process. Locking tokens not only helps combat proposal spam but also ensures that users dedicate more time to crafting higher-quality proposals before submitting them.

For a proposal to be considered, it must establish a quorum. Essentially, every governance proposal must garner a minimum number of voters who have cast their vote. Once a quorum is established and the results favour the proposal, smart contracts approve it.

Benefits of DeFi

Traditional banks can be expensive to run, and processing transactions often takes a significant amount of time. For instance, sending money to a friend in another country may take 2-3 days or even a week. Moreover, we have to agree to the rigid rules and regulations of traditional finance. DeFi was developed to address many of these issues, offering several key benefits as listed below:

- Permissionless: A major advantage of decentralized finance (DeFi) is its permissionless nature. This means that anyone can access DeFi applications and services without needing approval from a centralized authority, as long as they have an internet connection from anywhere in the world. Additionally, permissionless DeFi platforms tend to be more secure than centralized alternatives, as they are not vulnerable to single points of failure. This makes them ideal for storing value and participating in financial transactions. As a result, the permissionless nature of DeFi is an attractive feature for those seeking to engage with decentralized finance.

- Interoperability: Decentralized accounts provide developers with the flexibility to expand on top of existing protocols, customize interfaces, and integrate third-party apps. Due to this adaptability, DeFi conventions are often referred to as “Lego blocks” for finance.

- Transparency: Since most DeFi protocols are based on blockchain technology — a public ledger — all activities are accessible to the public. Anyone can view transactions; however, these records are not directly tied to any individual, unlike traditional banks. Instead, accounts are pseudonymous, listing only numerical addresses. Users with programming knowledge can also access most DeFi products’ source code to review or build upon since they are open source. Open-source codes tend to be safer and of higher quality than proprietary software, thanks to community involvement.

- Control: In traditional banking, financial institutions exercise significant control over how users can spend and use their money. They can impose restrictions on transaction types, block access to accounts if they suspect fraudulent activity, and even utilize users’ data at their discretion. Decentralized finance solutions, however, provide users with greater control over their own assets. For instance, users can manage their assets directly and decide which assets to interact with. This allows them to carry out transactions without involving a third party, making it more challenging for someone to steal their funds. Consequently, decentralized finance empowers users to better control their finances and protect themselves from fraud.

The Future of DeFi

According to data from blockchain analytics platform Dune Analytics, the number of DeFi users increased from 93,000 in January 2020 to 1.8 million in April 2021. Concurrently, the market’s valuation surged from $700 million to $58 billion during the same period.

Despite emerging during a stock market crash and global pandemic, decentralized finance has managed to become the industry’s next big thing. DeFi has expanded beyond a mere niche and annihilated the fear of evolving into an ICO-like fad. Furthermore, its robust performance has instilled worry into crypto’s centralized exchanges, which have lost a significant portion of liquidity to DEXs.

The disruptive potential of DeFi is apparent. A new decentralized future is upon us, and it should come as no surprise in the blockchain industry. However, a multitude of obstacles must be overcome before mass adoption can occur.

Smart contracts remain vulnerable to exploits, anonymous developers continue to act as vultures by launching rugpull projects, and the specter of regulations looms large. For now, DeFi is crypto’s wild west, and both creators and users must attain a certain level of maturity to establish the niche ecosystem as a prominent and credible sector in the new decade.

Achieving a perfected and balanced state will take several years, and the timeline hinges entirely on the community and its behaviour. Amid uncertain and chaotic times, it’s evident that disruptive technologies have a higher chance than ever to permeate the real world, and this presents an opportunity to make fundamental changes. The journey may be long and fraught with challenges, but one thing is certain: the future of finance is decentralized.

Conclusion

The remarkable growth of DeFi showcases its potential to revolutionize the financial industry through cutting-edge technology and its decentralized approach. As we advance into the future, DeFi is expected to overcome obstacles and progress towards mainstream adoption, emerging as a driving force for change in global finance.

At this pivotal moment, VE3, an IT Consulting and Services Company, plays a vital role in furthering the adoption and integration of DeFi solutions for various businesses and individual users. With the required expertise in navigating the intricacies of DeFi technologies, coupled with a deep understanding of the challenges faced by organizations in this space, VE3 is well-positioned to provide valuable guidance and support for clients seeking to capitalize on the DeFi movement.

By collaborating with partners to develop innovative, forward-thinking strategies and ensure seamless implementation of DeFi solutions, VE3 can empower clients to harness the full potential of decentralized finance. This collaboration will ultimately contribute to a transformative impact on the financial landscape and shape the industry for years to come.

Moreover, VE3’s involvement in the DeFi ecosystem extends beyond the technological aspect. The company help address the existing challenges of regulatory uncertainty and risk management. By offering comprehensive consulting services that encompass legal, compliance, and operational matters, VE3 enables organizations to navigate the rapidly evolving DeFi landscape confidently and responsibly.

In essence, VE3’s capabilities and expertise in the DeFi sector make it a valuable partner for businesses and individuals looking to embrace the potential of decentralized finance, fostering growth, innovation, and transformation in the wider financial industry.